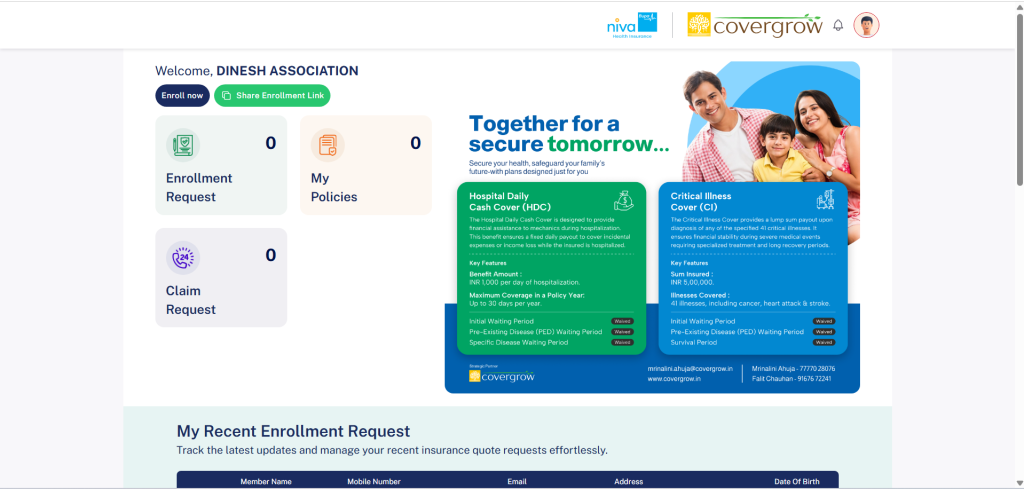

Affinity Health Program

Covergrow Affinity Health Program: Protection When It Matters Most

Covergrow Affinity Health Initiative:

Protection When It Matters Most

At Covergrow, we recognize the unique health risks faced by channel partners in their ecosystem, many of whom work in demanding environments, where exposure to pollutants, stress and long working hours can increase the likelihood of serious health conditions. Unfortunately, a critical illness diagnosis often brings not just medical challenges but also significant financial burdens.

To address this, Covergrow’s Affinity Health Critical Illness Program provides targeted financial protection, ensuring that they can focus on recovery without the stress of financial insecurity.

Why Critical Illness Cover?

A standard health insurance policy may cover hospitalization costs, but a critical illness cover goes beyond that, providing a lump sum payout upon diagnosis. This allows policyholders to manage non-medical expenses, sustain their livelihood and afford quality care — without depleting their savings.

Many life-threatening illnesses require long-term treatment, specialized care and lifestyle adjustments — all of which come with substantial costs. Our Affinity Health Critical Illness Program ensures that customers have the financial backing they need to face these challenges.

Key Features of the Affinity Health Critical Illness Program

Comprehensive Coverage for Life-Threatening Illnesses

Our plan covers a wide range of major critical illnesses, including:

- Heart Attack (Myocardial Infarction) – One of the leading health risks in high-stress industries

- Stroke – Ensuring financial support for rehabilitation and post-stroke care.

- Cancer – Covering early and advanced-stage treatments.

- Kidney Failure – Assistance for dialysis and kidney transplant expenses.

- Major Organ Transplant – Covering the high costs associated with transplants.

- Liver Diseases – Providing support for conditions like cirrhosis and hepatitis-induced complications.

Upon diagnosis of any covered illness, the policyholder receives a lump sum payout, which can be used for medical or non-medical expenses—giving complete financial freedom to the insured.

Lump Sum Payout Upon Diagnosis

Unlike traditional health insurance, which reimburses only hospital bills, our critical illness plan provides a direct lump sum payout upon confirmed diagnosis. This amount can be used to:

- Cover high-cost treatments, specialized medical care and long-term rehabilitation.

- Replace lost income due to the inability to work.

- Manage household expenses, EMIs, school fees and other daily financial commitments.

- Afford alternative treatments, travel for medical care or hire home nursing support.

Affordable Premiums with Group Pricing Benefits

By leveraging the affinity model, we negotiate high-value policies at competitive group rates, making it easier for our customers to access affordable critical illness insurance.

- Lower Premiums Compared to Individual Plans – Group buying power reduces costs.

- Exclusive for our Customers – Tailored benefits and pricing structures.

Flexible Fund Utilization

Unlike standard health policies that restrict payouts to hospital invoices, the Affinity Health Critical Illness Program allows policyholders to use the payout however they see fit. Whether it’s for medical treatments, loss of income, daily expenses or alternative care, the choice remains entirely with the insured.

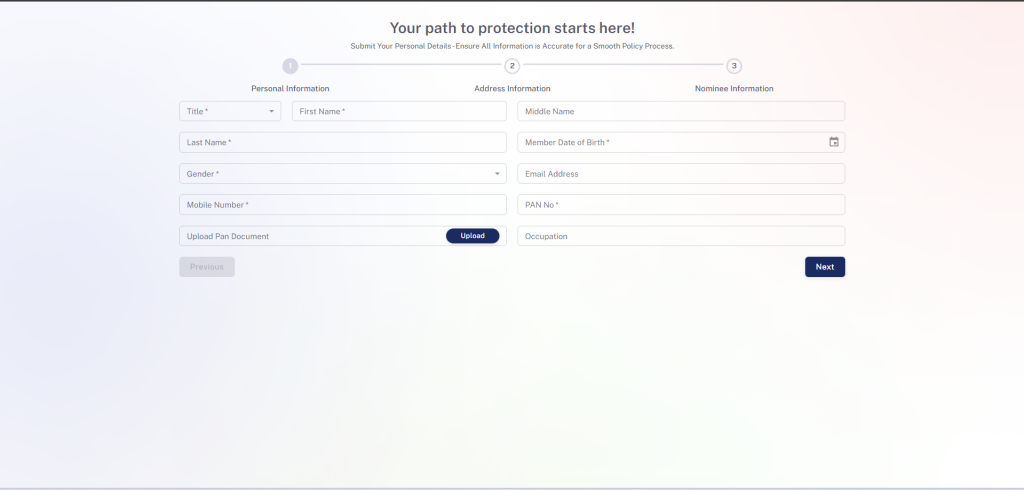

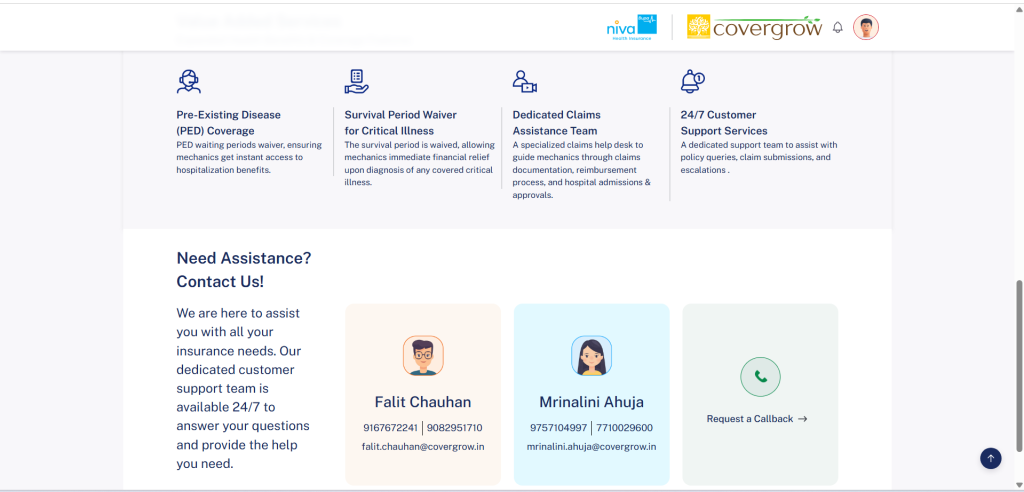

Hassle-Free Claims Process & Expert Support

We understand that dealing with a critical illness is already stressful, so we ensure a smooth and fast claims experience:

- Minimal Documentation – No lengthy paperwork; a simple claims process.

- Quick Payouts – Funds are released immediately upon diagnosis confirmation.

- Dedicated Claims Support – Our claims team assists at every step.

Everything you need to

grow your business

Registered Office

Gladys Alwares Road,

Thane West – 400610.

Corporate Office

101 Cosmos Court, S. V. Road,

Above Waman Hari Pethe Jewellers,

Vile Parle West, Mumbai – 400056

Covergrow

CIN – U72900MH2022PTC391584

Disclaimer

Covergrow Digital Solutions Private Limited is not a registered IRDAI member. All Insurance related solutions and transactions will be provided by registered IRDAI agents or any other IRDAI registered intermediary.